Fulfill your fiduciary responsibilities with a flexible compliance engine

Next-Generation Rules Engine

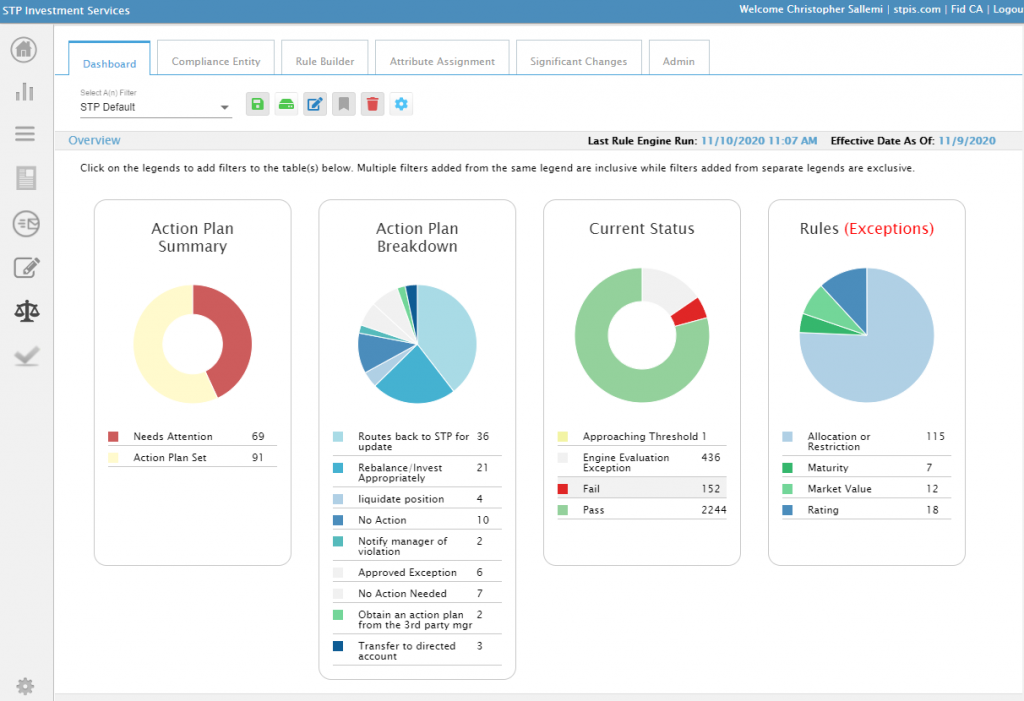

Traditional compliance solutions fail to highlight critical policy violations because of an inability to source data from disparate systems. To solve this industry bottleneck, STP has architected a cloud-based rules engine that can easily centralize unstructured data through extensive system and API integration. The flexibility of our rules engine has allowed us to develop compliance software that is truly data agnostic and provides limitless testing capabilities. Our real-time violation and threshold warning dashboard will ensure a strong compliance posture. Additionally, our software uses machine learning to enhance the rule matching process and automate the complex violation research effort.

Leverage our software to strengthen fiduciary compliance and increase client confidence.

Policy Rule Examples Include:

- Do-Not-Buy and Do-Not-Sell lists

- Asset and risk allocation

- Position limits

- Liquidity guidelines

-

Socially responsible restrictions

-

Duration, maturity and other analytics

- Investment strategy, sectors, region rules

Automated Violation Research

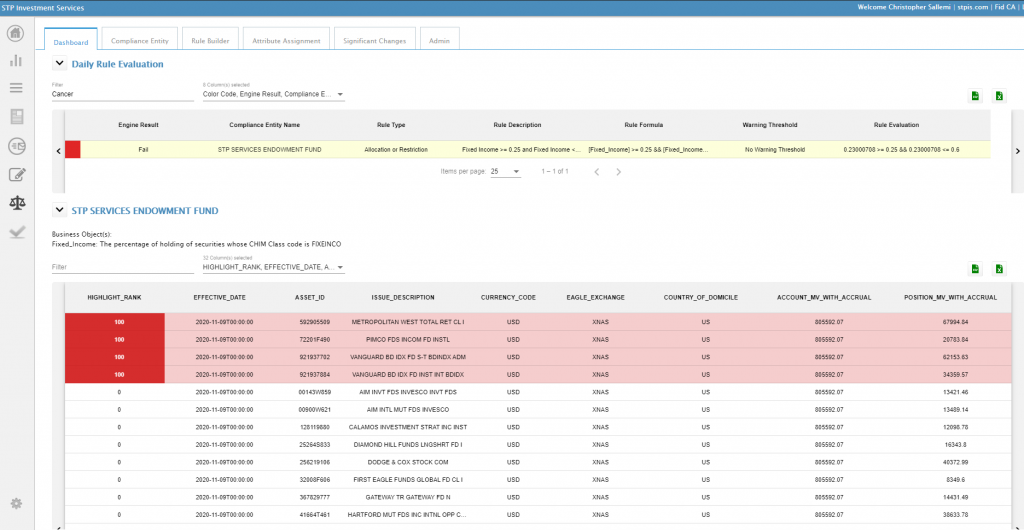

Our state-of-the-art rules engine allows end users to monitor all aspects of your clients’ portfolios including position, trade, security, and analytics level data.

- View daily and intraday rules engine violations and warnings

- Create custom action plans to ensure violations are acted upon quickly

- Enhanced data management tools that allow for complex rule creation using a user-friendly expression builder

- Proprietary automated research algorithm provides holding level risk violation score (1-100)