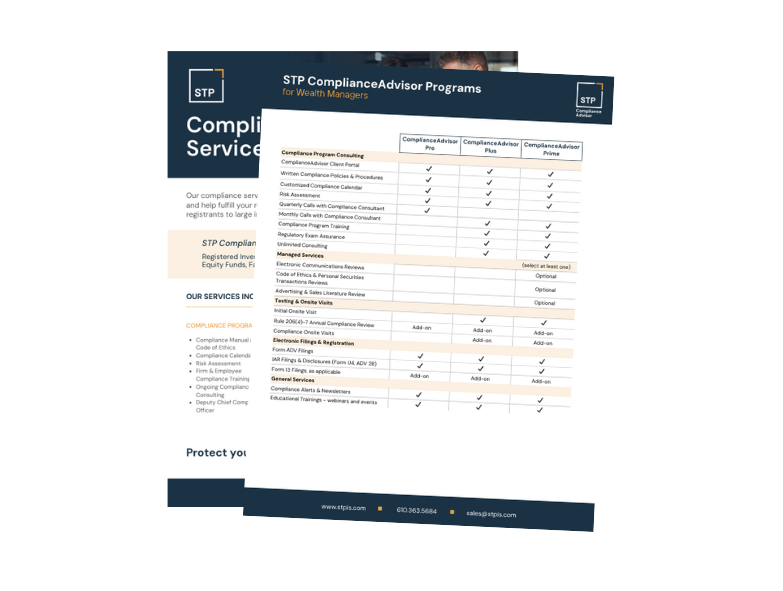

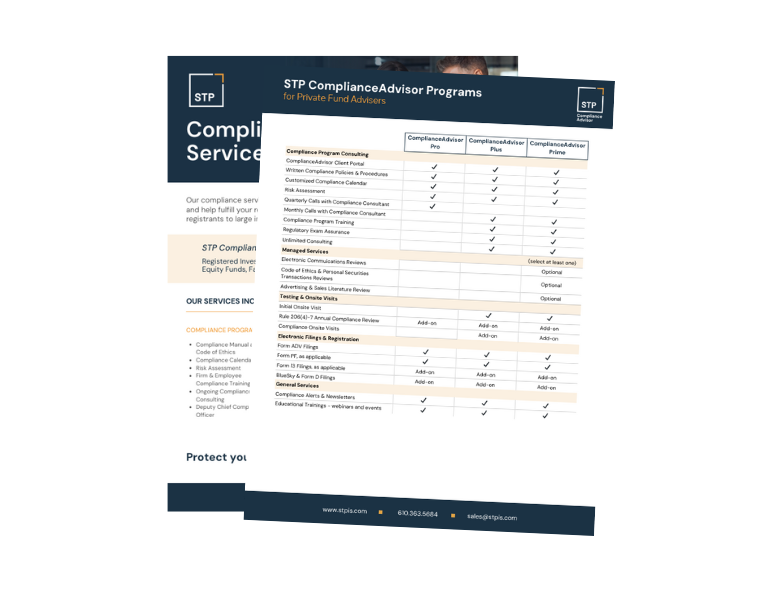

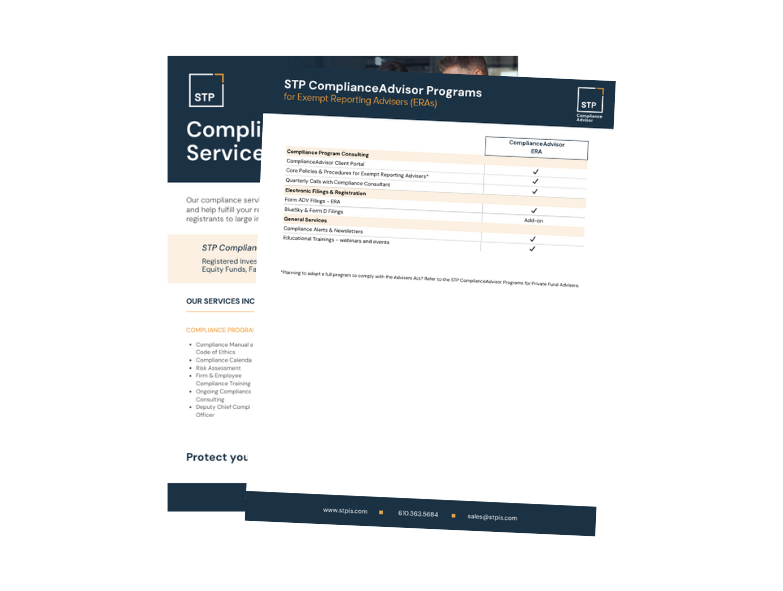

ComplianceAdvisor Programs:

Pro (Foundational Compliance):

This core compliance package covers essential services such as regulatory filings, the creation of a compliance manual, risk assessments, and a compliance calendar. It’s ideal for firms looking for basic compliance support without the need for extensive resources.

Plus (Strategic Compliance):

Expanding beyond the essentials, the Plus program offers monthly advisory check-ins, guidance to help firms stay ahead of regulatory changes, regulatory exam support, and unlimited consulting. It’s well-suited for firms seeking more proactive compliance management.

Prime (Total Compliance):

The most comprehensive service, Prime offers outsourced compliance functions, including personal trade reviews and electronic communications reviews. This program also includes the option to fully outsource the Chief Compliance Officer (CCO) role, making it a complete solution for firms seeking comprehensive and hands-off compliance management.

Recognizing the evolving regulatory challenges facing wealth managers, private fund advisers, and exempt reporting advisers, STP’s tiered approach offers three distinct compliance programs for RIAs. These programs provide various levels of support tailored to a firm’s current needs, while maintaining the flexibility to scale up or down as those needs change over time. This ensures that firms can adapt to the dynamic regulatory environment and focus on growing their business with confidence.

STP ComplianceAdvisor solutions are designed to integrate seamlessly with a firm’s existing infrastructure. By leveraging Hadrius regulatory technology, the program ensures comprehensive compliance calendar oversight and detailed risk assessments. Additionally, firms have access to Hadrius’ personal trade review, electronic communications, and marketing review modules, which can be used to further enhance their compliance processes. These tools help firms stay on top of regulatory obligations and mitigate potential risks.

The STP ComplianceAdvisor programs are structured to provide different levels of support to match a firm’s specific needs. Firms can select the service that best fits their requirements, whether they need foundational compliance services or a fully outsourced compliance solution.

This tiered approach ensures firms can access the level of compliance support that best suits their size, risk profile, and regulatory needs.