Performance services reimagined for tomorrow’s investors

Implement Performance Software & Expertise

Investment firms seek comprehensive performance data to assess manager returns. Delivering this level of insight demands both deep expertise and advanced, user-friendly software solutions.

STP’s performance services bring together skilled, CIPM-certified professionals and cutting-edge software, addressing critical areas such as:

- Investment Performance Measurement

- GIPS Composite Management & Reporting

- Attribution & Risk Analysis

This combination ensures precise, actionable performance insights for informed decision-making.

Investment Performance Measurement

Curious about how your portfolios perform against benchmarks, objectives, and risk? Our performance system delivers the insights you need!

- Calculate portfolio performance at all levels, from individual securities to total portfolio (net and gross)

- Leverage a variety of industry-standard calculations, including Modified Dietz and IRR (money-weighted), to effectively monitor performance and risk from an absolute or relative return perspective

- Customize segments (performance models) to calculate rates of return at both individual and composite / household (portfolio aggregate) levels

- Easily source and upload benchmark data from third-party vendors (ICE, EIKON, or client-based) for relative reporting measures, with custom benchmarking options available.

- STP CORE, our proprietary data interrogation tool, executes robust daily QA processes with automated exception tools, ensuring thorough quality control and rapid identification and resolution of errors.

Our STP secure data warehouse stores portfolio, segment, and composite-level performance and benchmark data, providing on-demand access to performance insights anytime, anywhere.

GIPS Composite Management & Reporting

Looking to achieve GIPS verification? We provide the tools and support to streamline the process with your verifier!

- Automatically manage composite and constituent relationships to efficiently handle large portfolios with evolving mandates over time

- Define portfolio inclusion rules that reflect the specific nuances of your composite membership criteria, such as minimum market value requirements

- Generate a diverse range of reports and GIPS-compliant performance presentations, with customizable options for selecting segments, securities, timeframes, data items, and more.

- Leverage professional relationships with top verification firms to expedite the verification process

- Import data from multiple exchange rate sources and provide performance reporting in an unlimited number of currencies.

Attribution & Risk Analysis

Trying to determine which securities, asset allocation choices, or fixed income factors drove your portfolio’s outperformance or underperformance? No need for additional third-party systems—we provide everything you need in one place!

- Uncover the sources of your returns with both equity (Brinson-Fachler / Karnosky-Singer) and fixed income (proprietary) attribution analysis

- Utilize ex post risk measures, including Tracking Risk, Sharpe Ratio, and Treynor Ratio, to gain insight into the risks associated with your performance

- Get daily sub-security-level contributions and attribution for long and short positions, as well as multi-asset and multi-currency returns

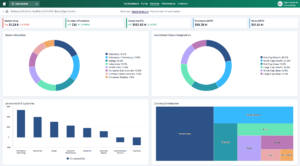

- Benefit from extensive data visualizations that highlight time-series and point-in-time performance and risk metrics

- Address traditional technical smoothing and component calculation challenges with daily Modified Dietz & IRR calculations

- Seamless data integration with STP’s Data Warehouse eliminates the need for reconciliation between attribution returns and performance returns.