Increased Transparency, Increased Scrutiny: Private Funds Navigate New SEC Rules

Increased Transparency, Increased Scrutiny: How Back Office Support Can Help Private Funds Navigate New SEC Rules

By: Anthony V. Mannino, Esq.

The landscape of private fund investing underwent a significant shift in August 2023, when the Securities and Exchange Commission (SEC) adopted a series of reforms targeting private fund advisers. These new regulations aim to strengthen the industry with enhanced transparency, investor protections, and governance standards. They also introduce additional compliance burdens for private funds.

What will the rules require?

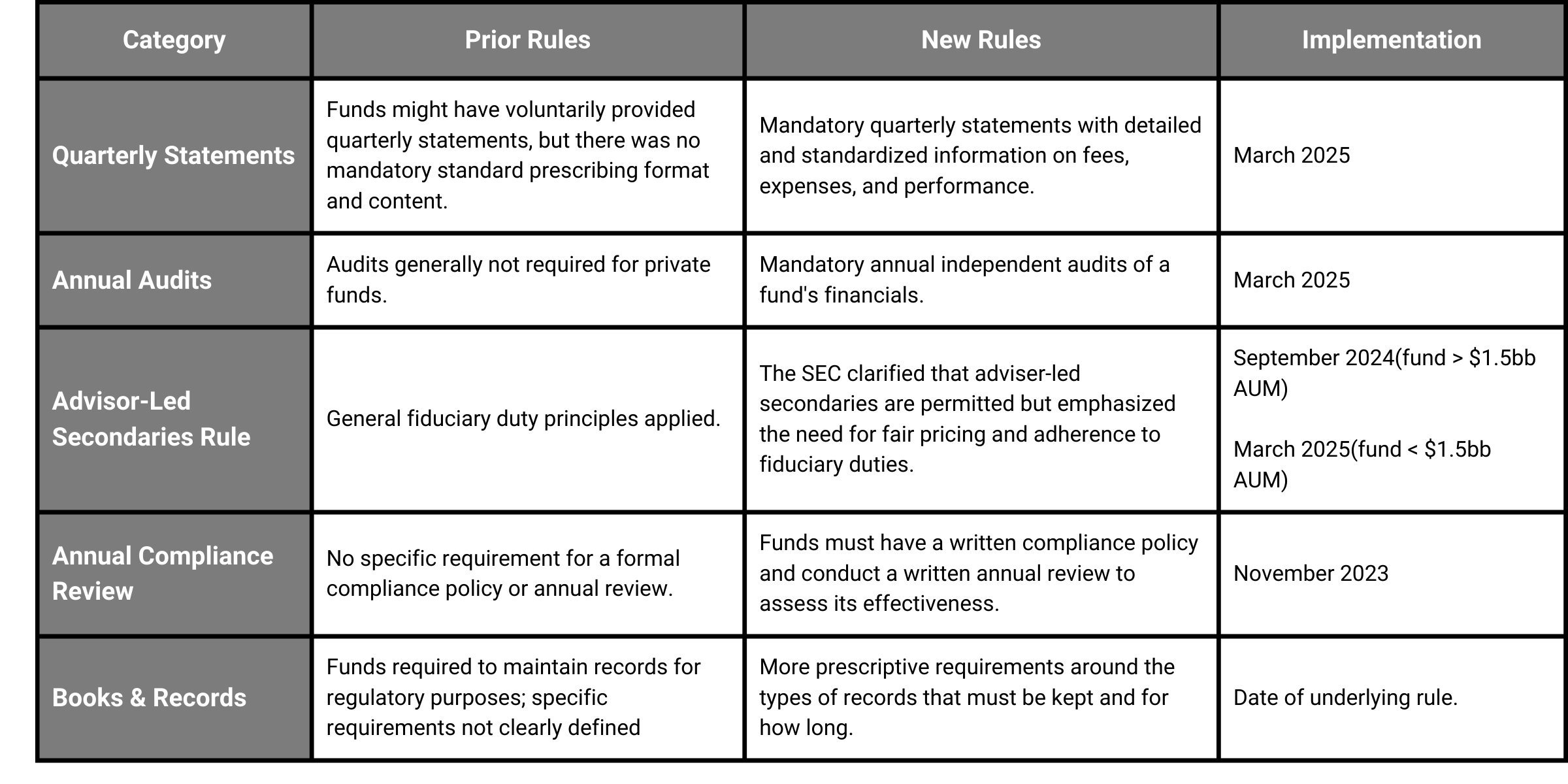

The most notable changes impact financial reporting, recordkeeping, and investor notices for registered funds (RFPAs):

- Quarterly Investor Statements will be required, with detailed fee, expense, and performance information, as well as adviser compensation details.

- Annual Independent Audits must be performed and delivered to all investors.

- Permissible Fees have now been detailed under the Restricted Activities Rule.

- Fairness or Valuation Opinions and conflict disclosures for Adviser-Led Secondaries will be required.

- Preferential Treatment notices to prospective and current investors (where preferential treatment still permitted) will be required, with new requirements for information to be included.

How back office administration can help funds adapt

Meeting these new requirements demands a robust infrastructure and streamlined processes. Back-office administration services can provide private funds with several advantages:

- Enhanced Compliance: Seasoned back-office administrators stay up-to-date on evolving regulations. They can help with tasks like generating compliant quarterly statements, managing audit preparation, and ensuring adherence to preferential treatment disclosure rules.

- Improved Efficiency: Back-office teams handle a range of administrative tasks, including investor onboarding, accounting, and recordkeeping. This frees up internal staff to focus on core investment activities and client relationships.

- Cost-Effectiveness: Building and maintaining an in-house back-office team can be expensive. Partnering with a specialized service provider allows funds to access expertise at a potentially lower cost.

- Risk Management: Experienced back-office administrators can identify and mitigate potential compliance risks associated with the new regulations.

When do the rules go into effect?

| ALL FUNDS |

The SEC’s reforms will affect all Registered Private Fund Advisers (RFPAs), Exempt Reporting Advisers (ERAs) and non-reporting advisers with the following new requirements:

| RFPAs ONLY |

Registered Funds will have additional requirements: